Are you a property investor

(or planning to be one)?

If you are interested in making money out of property, we can help you. Making money out of property is easy, once you are shown how. The key is to get the right team around you, and use their knowledge. This avoids making costly mistakes, and speeds up the wealth creation process.

There are lots of benefits to property investment in New Zealand:

- Property offers the ability to create wealth through adding value.

- Buy a run down house, renovate and revalue. Do a dwelling conversion. Create another bedroom or rentable dwelling. There are so many ways to add value.

- Lots of investors buy property and add value to it, creating a 'step up' in value, often in the first four months of ownership. This can result in tens of thousands or hundreds of thousands of dollars in equity made, in relatively short time frames. Worked examples are further down this page.

- Creating instant equity allows your deposit to be recycled (returned and used again in subsequent investments.) So you can keep investing, not 'tap out' on your first or second property running out of financing ability (like many investors do).

- It also makes money when you buy - often much more than you make from a salary or self-employment.

- Property provides investors with the benefit of leverage.

- If you purchase, say, $1 m of property with a $300k deposit, you get growth on $1m while only investing $300k of your own money. This represents 70% leverage.

- You can even borrow the $300k deposit against your existing home. So that represents 100% leverage.

- You can't normally do this with shares. So even if the returns on shares equal property over time, the benefit of leveraged property outperforms non-leveraged shares by far.

-

Lets say the $1m of property doubles in value over 10 years, (which has been normal for the last 40 years in New Zealand in the better areas).

- Then you get $1m of growth, on either $300k invested or $0 invested (if you borrow the deposit).

- $1m growth as a return on $300k invested, is a 330% cash on cash return (not adjusted for inflation.)

- If you borrowed the full amount of the purchase (using cross security to your home or other assets), then you made $1m out of borrowing $1m.

- This is the benefit of leverage, and many investors have got rich doing this.

- Cash yields on property in New Zealand can be very high, if you target cash flow strategies.

- Net yields (after operating expenses) of above 5% are not uncommon.

- If your cash yield after operating expenses (net yield) exceeds the cost of borrowing, you are cash flow positive.

- With interest rates falling in New Zealand from 2019 to 2021, it is relatively easy to generate cash flow from property, if you know what you are doing.

- Property gains are non-taxable in New Zealand for most long-term investors, and we have no stamp duty or specific land taxes.

- No stamp duty: NZ has no stamp duty, which saves investors typically 3-7% of the purchase price, when compared with overseas jurisdictions. This also makes property trading (discussed below) much more viable in New Zealand.

- Property is tangible 'bricks and mortar' - it physically survives a market meltdown. Often paper assets like shares disappear when businesses fail, while houses still stand and have their tenants paying rent.

- Recycling deposits and re-investing creates some very large investors out of small households, and enables a path to a better retirement for many Kiwis or foreign investors in New Zealand. This would be otherwise unattainable in unleveraged equity or cash savings schemes, if they took that path to save for retirement.

- Your family home, if purchased strategically can provide excellent capital growth, which again is untaxed in New Zealand. If you use property investment principles when buying your home, you get even higher gains.

- Property as a job: use property trading to replace your income. Get a new life earning huge profits from simple strategies.

Taking Action With

Taking Action With

Support From GRA

Using a variety of reliable strategies to create a portfolio of investment properties is a proven way to build wealth, and at GRA we can show you exactly how to do it. To facilitate this, we have a number of related partners and subsidiaries, tools and education programmes that assist clients with:

- Tax structures (Trusts, companies, LTCs, tax advice)

- Finance (Mortgage brokers)

- Property education (On demand - pay and watch, or live events)

- Property analysis tools (Do the math right)

- Area research tools (What's it worth? Comparative market research)

- Property mentoring (Direct supervision)

Talk to our GRA team if you want to learn more - we can assist you if you are time poor, or show you how to do it yourself by helping you get educated and providing you with the tools you need to purchase property at the right price.

Click the buttons below to learn more about these topics directly, or read about the investing process and example strategies further down the page. Or watch one of our comprehensive Property Investment & Education Seminars, presented either by live Zoom webinar or as an on-demand recorded version.

Click the bubbles that interest you below:

Ways to learn about

property with GRA

- Education: We have cloud-based education available, with a huge volume of videos and online learning.

- Take a structured course - our Property School 7-module course, available online on demand (recorded) or from time to time via live Zoom webinar.

- Attend a Property Investment & Education Seminar, online (live Zoom webinar or on demand).

- Property Investment Mentoring: Use our property consultants to help you create and/or implement a strategy for your personal circumstances (e.g. buy & hold, trading, development). Book a property planning meeting here.

- Analysis Tools: Use our cloud-based property investment analysis tools, that forecast returns and help you focus on what's important, like purchase price discount, capital recycle, cash yields and net operating income. Use our client property analysis tools for different types of investment and different strategies, including:

- Buy to hold

- Trading

- Houses of multiple occupancy (HMOs)

- Subdivision and development

- Research Tools: We have excellent property research tools that allow you to prepare a current market analysis, and determine quickly what values in an area are by doing a radius search. A

radius search is a search of recent sales in an area, with defined parameters.

- For example, sales of properties within the last 12 months within 1 km of a house you are interested in, that are of similar characteristics

Property analysis tools make sure you get all the numbers into your property analysis and don't leave important information out or use incorrect numbers.

Property Investment

Strategies

Where do you start in property?

There are so many opportunities for small investors and businesspeople to get stuck into. Typical strategies that GRA can help with are discussed below. Work your way through the strategies, and if something resonates, give us a call, or start using our online education.

But don't get too excited; talk to us before you buy anything, so we can:

- Check the deal is ok

- Check your tax and legal structures

- Assist you with the best investor finance solution

-

Provide consultancy over the asset, strategy and area

SAP – Strategy, Area, Property

When investing, consider SAP (strategy, area, property), a common approach to optimising your property selection. This is a hierarchy: start with strategy, then area, then look for the property.

Strategy – What are you doing?

Holding, trading, developing? What specific strategy related to this? E.g. dwelling conversion for cash flow.

Area – Based on your strategy, what area is best?

Not all strategies work in all areas. So strategy selection, then area selection.

Property – Having picked your strategy and area, what sort of characteristics of a house are you looking for, to meet that targeted strategy outcome? (Find the house, and perform verification of the numbers, viability and strategy being applied to that property. This is a science, not an art. Meaning you can work it out and verify your assumptions using a process, before you buy the property and make a mistake. This is best done with help from experienced investors, if you are new to the process. We can help with this through education and mentoring.)

By starting with strategy, then picking the appropriate area, and then picking the property, you get a better outcome. For example, you generally won't find cash flow properties in high growth areas. So if you are chasing high growth, you pick a growth area, then the property. If you are after higher cash flow, you choose a typically high cash flow area, then pick the property. Another example if you are looking for high cash flow, is to consider a boarding house or 'rent by the room' strategy, collectively referred to as HMOs (houses of multiple occupancy). These only work in certain areas. So Strategy: HMO Area: Near universities, language schools, or centres of employment. Property: Large house with lots of rooms.

Reducing risk through verification

Use experts to verify, and reduce risk. At GRA, we have a one-stop-shop of advisers, partner organisations and people to assist in due diligence and strategy execution, along with clever chartered accountants and tax people, advisory services, and cloud-based learning.

Builders say measure twice, cut once. At GRA we say, check twice, buy once. Get it right the first time, and avoid traps and novice mistakes.

.jpg)

Common Property

Investment Strategies

Buy & hold property, for long-term investment

As the name suggests, this is about buying property and owning it long-term while renting it to tenants. Your goal is both cash flow during ownership, and long-term growth (which you get when you eventually sell). This is also known as creating passive income. Generally there are two main types of buy and hold properties, and you need both to create a successful portfolio:- Cash flow property: These properties provide you with income (cash flow). The rent covers all the costs of owning the property (including loan payments) and provides a surplus above this. If you get enough cash flow to replace your job, you become financially free. You choose to work or not, the choice becomes yours. Which is what this is all about.

- Capital growth property: These are the properties that increase in value markedly over time, due to their location.

- Often the rental income does not cover the costs of ownership for capital growth properties, so you have to inject money from elsewhere to cover the loan payments.

- These assets tend to be higher value and in better areas.

- Your family home should also come under the category of capital growth property.

The capital growth properties will substantially build your wealth and the cash flow properties give you the cash flow means to do so. You need a balance of both in a portfolio, and there are a few tricks to doing this successfully, which our team at GRA can show you.

Even smarter, you can try to use specialised cash flow strategies, to get cash flow out of high growth areas. These sorts of strategies, which we teach, give you a huge advantage over other investors who don't know how to target the higher gains. It is all about learning the smart strategies, so you can optimise your investing.

Instant Equity: Making money when you buy

Whether you are trading or buying to hold, one of the keys to being successful in building a lager property investment portfolio is adding value when you buy.

When done correctly, 'adding value' allows you to make instant equity (gains) in the first 3 to 6 months of ownership. This de-risks your investment, because if the market falls, you lose profit, not cash. You also make money, which is what it is all about.

For example, if you have purchased a house for $400,000, spent $50,000 on a renovation, and it re-values at $600,000 on completion, you have made $150,000 of instant equity (after revaluation).

- If the market was to fall 20% ($120,000), you would lose $120,000 of your $150,000 instant equity gain. In other words you lose your profit, not your cash invested. This de-risks your investing.

- With the right finance in place, you can borrow against the increase in value, and return much of your cash invested. In this case you might borrow up to 70-80% of the $150,000 gain, returning most (or all) of your cash invested into the property.

- This allows you to 'recycle' your deposit and renovation money into another property, and grow a larger portfolio. GRA and NZPM can teach you some strategies for doing this.

Strategies to add instant equity

Common examples of adding value include renovation, adding a room, adding another rentable space (a flat), subdividing land off the back, and adding second dwellings (within the house, or building in the front or back yard).

Example

Let's say you find an Auckland property in an investor area. It was once a 4-bedroom house but past owners have opened one of the bedrooms up to provide a bigger lounge. The property is run down and shabby. It is currently owner-occupied, and the owner either doesn't notice the mess, or doesn't have the money or inclination to fix the property.

You buy it for $550k, and renovate it for $50k. Included in the renovation is reinstating the wall to make the house 4-bedroom again. Putting a wall up costs very little, and $50k is a pretty standard renovation budget in Auckland for a trade or rental. For that you should be able to get a new kitchen and bathroom, repaint, re-carpet and do some basic landscaping. And address any wiring or plumbing issues.

You borrow 100% of the purchase price using another property you own (say your home) as security for the purchase. Or maybe you use a relative's property, or get some vendor finance - you find the deposit however you are able.

On completion, two things happen:

- The house re-values at $725k. You paid of $550k plus $50k renovations (i.e. a total of $600k), meaning you make $125k on $725k, which is a purchase price discount of 17%.

- The rent increases to $600 per week.

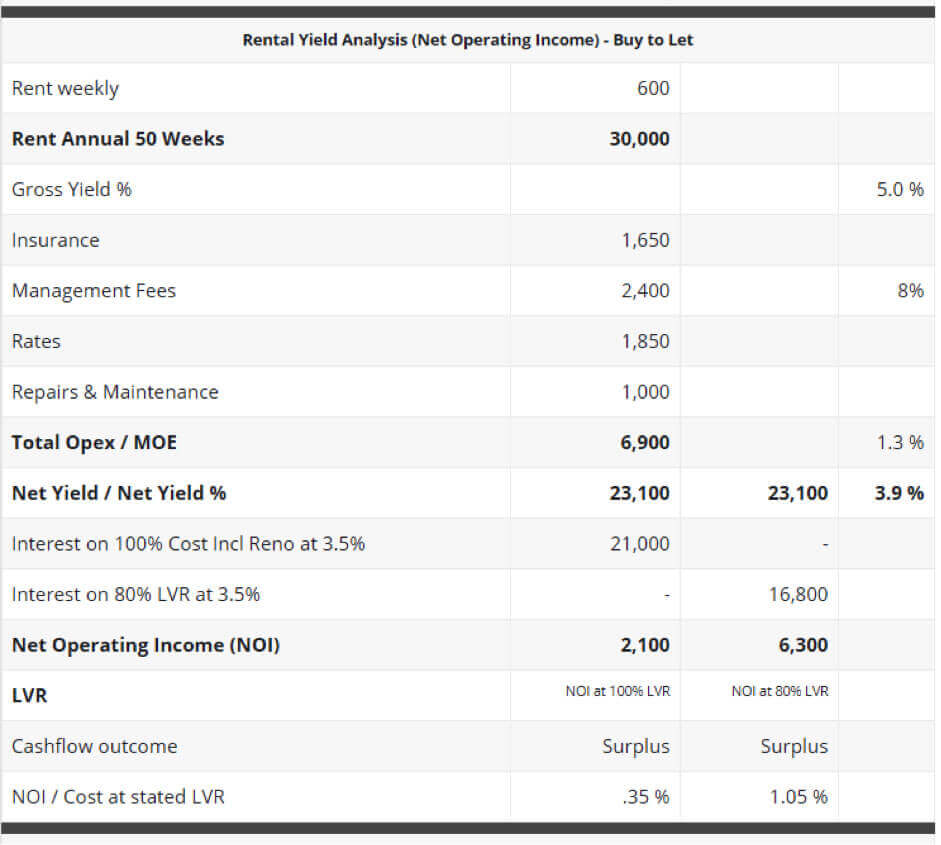

Below is a summary of the cash flow of this investment example, using our investor Property Analysis Tool in our Wealth Suite.

Note that sometimes it won't be possible to borrow the entire purchase price upfront. In the future, the asset should grow in value and you can recycle your deposit out. In the meanwhile, at the stated interest rate the asset is positive cash flow $6,300 at 80% LVR If you borrowed the deposit, after interest on the deposit the investment is $2,100 positive cash flow overall. So you have a renovated asset in Auckland producing positive cash flow. Not bad.

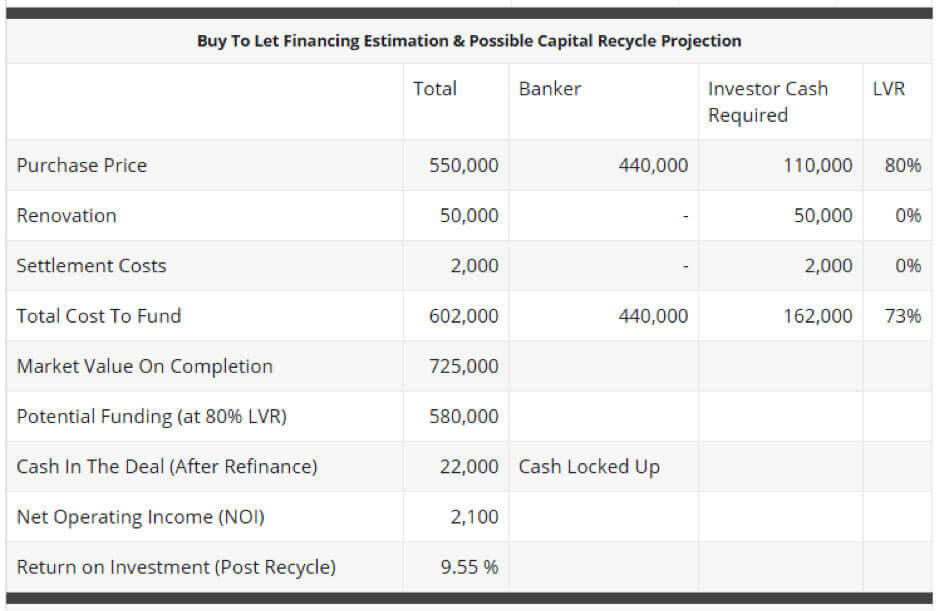

Looking at the way we approach finance and using our Property Analyst Tool in the Wealth Suite, the financing looks like this:

Key points

- The investor needs to fund the 20% deposit in this example, plus the other costs including renovation and settlement, a total of $162,000.

- On completion, the investor can borrow against the re-valued property and get $140,000 of the $162,000 recycled back, leaving $22,000 cash locked up.

- Not every property (especially in high capital growth areas) will generate enough cash flow to be able to pay for itself, like the one in our example. But it is something that a good investor should be aiming for.

Trade property

Trade property

Are you looking to stop what you are doing, and replace your job with property trading? Or are you looking to generate wealth and income, in parallel with your existing business or employment?

Property trading involves buying a property and then on-selling it for a profit. It can replace your job, or act as an excellent source of income and wealth generation.

The main ways investors make such profits are by buying property that is suitable for adding value to, and then selling at market value. There are many ways to add value, e.g. through renovations. Here are some examples of 'value add' properties in Rotorua.

Example 1: Te Ngaire Road

Simple renovations (e.g. updating paint to modern trends and fixing run-down assets) can mage a huge difference to appearance and value.

You can see the investor has cleaned up and repaired a house that was in very poor condition. New kitchens, bathrooms and floor coverings, repainting, and making the house healthy and secure, increase the value. The key is to project the end value, and make sure you don't spend more than the house is worth. That's called over capitalising, and instead of getting instant equity, you get equity loss.

Example 2: Clayton Road

With this property, the investor reinstated an internal wall to convert the house back to three bedrooms from two. This, along with a cosmetic renovation, increased both rent and market value.

Example 3. Thomas Place

Sometimes a simple bit of painting and landscaping makes all the difference, like this unit in Thomas Place. Painting the exterior was quick, cheap, easy, and above all, effective.

Rent by the room/Houses of

multiple occupancy (HMOs)

Buying a property with many rooms and renting it out on a room-by-room basis, is a very effective way of increasing cash flow. As part of the arrangement, you provide internet, shared facilities, and agree that each tenant is only liable for their single room. Here are some figures to illustrate how such an arrangement might look.

Example

- Say the property is worth $550 per week as a 5-bedroom house.

- On a rent-by-the-room basis, you can get $250 for each room, or $1250 per week, which represents a vast improvement in cash flow.

- From this you deduct the operating expenses, power, water, internet and outgoings.

You will find that if you learn this strategy, it is a great way to increase cash flow. However, the rent-by-the-room strategy will not work with every multi-bedroom property; it is best suited to properties in areas popular with students or near employment.

You also need to be careful when you cross over into boarding house territory, which is more complicated with regard to regulations and tax, but can provide better income again. You do need to be mindful of the implications and costs of the regulations, and changes in tax and residential tenancy laws that affect a boarding house. Talking to one of our team or learning through our Property School is a great way to get into HMO investing in New Zealand.

Learn more about this strategy in our online education programmes.

Property development

Development covers a broad spectrum of activities including:

- Subdivision (turning a larger piece of land on one title into two, three or many lots, with their own separate titles)

- Infill housing (subdividing and then building on the new lots), or larger development projects for commercial or residential property

- Developing sections

- Building houses

Our resident property expert, Matthew Gilligan, has developed over 230 sections and built many houses for resale. His expertise in development, strong background in taxation and legal structures, and on-the-job experience in property make him a great adviser to have in your team for planning and conducting property developments and putting your fundamentals in place.

Getting the tax structures right, getting the banking right, planning the costing, and project management are things GRA and our development consultancy, Property Central (a subsidiary of GRA), can start you off in the right direction with.

Taxation and legal structures

(for property)

Designing the right tax structure is essential for asset protection, tax minimisation, and controlling your bankers. For example, you should try to separate your home from your investment bankers so if something bad happens, your home is not automatically taken by the bank. To do this, you need a blend of trusts and companies, and the right finance broker working with your accountant. This is what the GRA asset planning team do. They work with clients to get your tax structures right first time.

Putting It All Together

& Taking Action

At GRA we use of a blend of mentors, accountants and good finance brokers, that together make up our clients' team of experts. Using our recommended team de-risks trading and investment, because experience stops you making expensive mistakes.

Identifying all the costs and the likely selling price, is part of the science of property investment. The Property Analysis Tools in our Wealth Suite are a great way to identify costs. Coupled with experienced people, this significantly reduces risk for investors. Everything you might be considering doing has been done before. By taking advice from experienced investors who are in the game themselves, you can avoid many of the pitfalls and mistakes that people make.

To book a property planning meeting with a GRA property consultant, click here.

For taxation, structures and accounting assistance, click here to meet with GRA.

Why have GRA as your

property accountant?

- You need to be set up correctly for asset protection and tax. GRA are experts in this field, and can help you structure your investments in a way that minimises your exposure to risk and maximises your returns.

- This includes forming companies, trusts or whatever is the recommended structure. Read more about the asset planning process here.

- We also look at your business affairs, and the way business structures interact with property structures.

- We assist with trust creation, management and estate planning as part of the process. Its not just about tax.

- You need to make sure the numbers work, and running any prospective purchase past an expert property accountant is highly advisable.

- It's easy to make mistakes when analysing deals, leave costs out, overestimate the value on completion - especially when you are first starting out.

- This is where our experienced team at GRA can really help. We use GRA's Wealth Suite property analysis tools, so you have both the team and the tools to keep you safe.

In general we have fixed fees for compliance accounting, and setting up tax structures including LTCs, trusts and companies. So you know where you stand with costs up front.

Key tools we use

Wealth Suite property analysis tool

This is a multi-functional tool. It is a paid subscription product, designed and owned by GRA, and

Taking Action With

Taking Action With.jpg) Trade property

Trade property