Deliveries

Hard copy books are sent via courier and usually take 1-3 business days to be delivered once we have processed the order. (Note, we are unable to courier to PO boxes.) E-books are emailed instantly.

By Matthew Gilligan

If you want to know how to invest in residential property in a way that maximises your chances of success and minimises risk, this is the right book for you.

Matthew Gilligan provides a fresh look at residential property investment from an experienced investor’s vie..... More

$20 incl GST

DOWNLOAD

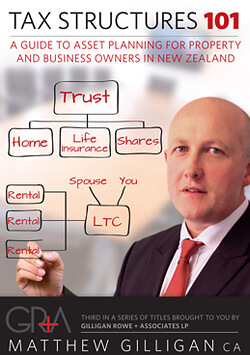

By Matthew Gilligan

Interested in paying less tax, property investment structures, trusts and protecting your assets? This is the right book to read.

Try asking two lawyers and two accountants "How should I own my property and business assets?" You will likely get four different answ..... More