If you've ever wondered whether gold and precious metals belong in your investment portfolio, you're not alone. Many Kiwi investors are curious about these "alternative" assets but aren't sure where to start. In this article I look at the sorts of things you need to think about.

Why Consider Precious Metals?

Precious metals such as gold and silver can be like a financial safety net. They are non-correlated assets that often act as a stabiliser. In fact in some periods, like 2024–2025, they have even outperformed traditional investments like property and shares.

Insurance for Your Wealth

Gold and silver act as a hedge against inflation, currency devaluation, and economic instability. When the value of paper money decreases, whether through inflation or other economic pressures, precious metals tend to hold their value. In a world where governments continue to increase debt levels and implement monetary stimulus programs, gold can preserve your purchasing power in ways that traditional currencies can’t.

Diversification

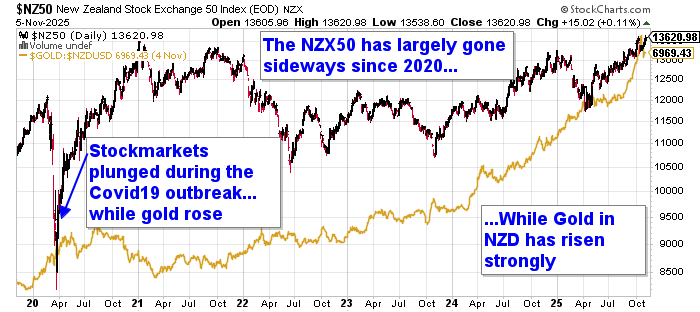

Many New Zealand investors have portfolios heavily weighted toward residential property and shares. Precious metals are what's called "non-correlated assets," meaning they often move independently from these traditional investments. When property or share markets struggle, gold and silver can provide stability, smoothing out your overall portfolio performance. Have a look at the graph below which shows how gold has fared in comparison to shares over the last five years.

Tangible Assets

Unlike shares or bonds, which are essentially promises on paper (or digital records), physical precious metals are real assets you can hold. There's something reassuring about that, particularly during uncertain economic times.

How Much of Your Portfolio Should Be in Metals?

There's no one-size-fits-all answer, but most financial experts suggest allocating somewhere between 5% and 20% of your portfolio to precious metals. Where you land within that range depends on your personal circumstances and outlook.

If you're relatively confident in the economic system and primarily want diversification, 5-10% might be appropriate. However, if you're more concerned about systemic risks, such as banking instability, significant inflation, or other economic disruptions, you might feel more comfortable at the higher end of that range.

The key is to view this allocation as long-term wealth insurance rather than a short-term growth strategy. Your precious metals holdings should help you sleep better at night, not keep you awake worrying about daily price movements.

Physical Bullion vs. Paper Gold: What's the Difference?

One of the first decisions you'll face is whether to buy physical precious metals or invest through "paper" options like exchange-traded funds (ETFs) or mining company shares.

Physical Bullion: Real Assets You Can Hold

When you buy physical gold or silver bars and coins, you own the actual metal. There's no counterparty risk, meaning you're not relying on any company or institution to honour a promise. If economic systems face serious challenges, you still have your metal.

ETFs and Mining Shares: Paper Alternatives

Gold ETFs and mining company shares are easier to buy and sell through your regular brokerage account, and they don't require you to worry about storage. However, they come with counterparty risk and market risks. You're essentially holding a promise or a business interest rather than the actual metal. While these investments can offer potentially higher returns, they're more about speculation than genuine wealth protection.

The Recommended Approach

For most investors seeking diversification and safety, the strategy is straightforward: establish a core holding of physical bullion first, then consider paper exposure if you're interested in speculative gains. Think of physical metal as your foundation and paper products as optional additions for potential growth.

What Type of Bullion Should You Buy?

Not all gold and silver products are created equal. When you're starting out, keep it simple and stick with widely recognised, high-purity products.

Purity Standards

Look for gold that's 99.99% pure and silver that's 99.90% pure. This is standard for investment-grade bullion and ensures maximum liquidity when it's time to sell.

Reputable Sources

Purchase bullion coins or bars from well-known mints such as the Perth Mint, Royal Canadian Mint, or reputable local refiners. These products are instantly recognised by dealers worldwide, making them easy to sell.

Avoid Collectibles (unless you're an expert)

Rare or collectible coins might sound appealing, but they carry significantly higher premiums over the metal's actual value and can be difficult to sell. Unless you're an expert in currency collection, stick with standard bullion products. You'll get more actual metal for your money, and you'll find it much easier to sell when the time comes.

Where Should You Store Your Gold?

Once you've purchased precious metals, you need somewhere safe to keep them. Each storage option has its pros and cons.

Home Storage

Keeping your metals at home can be a good choice for smaller holdings and offers immediate access. However, it comes with security concerns and insurance complications. Most standard home insurance policies have strict limits on precious metals coverage, and you may need to purchase additional coverage, which can be expensive or difficult to obtain.

Bank Safe Deposit Boxes

These have traditionally been a popular option, but they're becoming increasingly limited. Not all banks offer them anymore, and importantly, the contents aren't always insured by the bank. You'd need separate insurance, and access is limited to banking hours.

Professional Secure Storage

Third-party secure storage facilities offer insured, audited, and segregated storage. This means your specific metals are kept separately from others, they're fully insured, and they're subject to regular independent audits. For serious wealth protection, particularly with larger holdings, this is often the most practical solution. While there's an ongoing storage fee, you gain peace of mind, professional security, and 24/7 monitoring.

Understanding Liquidity and Your Exit Strategy

One of gold's major advantages is its liquidity – it can be converted to cash relatively quickly. However, you should understand how this works before you buy.

Premiums and Spot Price

The "spot price" is the current market price for pure gold or silver. When you buy, you'll pay a premium above spot to cover manufacturing, distribution, and dealer margins. When you sell, you'll typically receive slightly less than spot. Understanding this helps you buy smartly and manage expectations when selling.

Have a Sellback Plan

Before you purchase, understand how and where you can sell your metals back. Reputable dealers typically offer buyback programs at competitive rates. Knowing your exit strategy in advance prevents panic selling at unfavourable prices if you need to liquidate quickly.

Tax Considerations

Tax on sale

The tax treatment of precious metals sales can be complex. The New Zealand IRD hold a default position that gains realised on selling gold bullion are taxable.

There are a couple of points to note on this.

• A taxable gain can only be realised on disposal – not on unrealised increases in value.

• Secondly, it is a “default” position, meaning there is some scope to argue that you are not taxable on gains on disposal where you do not have a purpose of disposal when you make the investment. The onus for proving this sits with the taxpayer.

Tax advice on your personal circumstances is essential when buying and/or selling precious metals. The team at GRA can help you with this.

GST

In terms of GST, the supply of the following metals in any form (e.g. physical bars, coins) are GST-exempt:

• Gold with a fineness of 99.5% or above (approximately 24 carat)

• Silver with a fineness of 99.9% or above (fine silver). Note that sterling silver has a fineness of 92.5%.

• Platinum with a fineness of 99.0% or above (fine platinum)

Due to this requirement to have a fineness of not less than 99%, some popular coins, such as the South African Krugerrand, the American Gold Eagle, and the British Sovereign (all of which are 22 carat / 91.67% fine), are not exempt from GST.

Global Trends New Zealand Investors Should Watch

The precious metals market doesn't exist in isolation. Several global trends are worth monitoring, as they can affect both prices and the strategic value of holding metals.

Central Bank Buying

For the first time in decades, central banks worldwide have become net buyers of gold, adding it to their reserves. When the institutions managing the wealth of nations choose to hold more gold, it's a meaningful signal about confidence in the global monetary system.

Geopolitical Shifts

Growing demand from Asian economies and BRICS nations (Brazil, Russia, India, China, and South Africa) reflects a global pivot toward real, tangible assets. These demographic and economic shifts are long-term trends that support demand for precious metals.

Currency Considerations for Kiwi Investors

The gold price in NZD is influenced by both the global gold price (usually quoted in USD) and the NZD/USD exchange rate. Even if the gold price in USD stays flat, a weaker NZ dollar can cause the gold price in NZD to rise, increasing the value of your holdings here.

For example, if the NZD drops against the USD due to local economic issues, your gold (priced in USD) becomes more valuable in NZD terms. This currency dynamic can add an extra layer of protection for NZ investors, not just from global events, but also from local economic or political shocks. This is particularly important for investors already exposed heavily to the NZ economy via property or business because gold helps hedge both international uncertainty and domestic currency risk.

However, bear in mind that this currency effect can also work against you. If the NZD strengthens against the USD, your gold holdings may not gain as much in NZD terms, or could possibly decline, even when the USD gold price is rising. That said, movements in the global gold price typically have a larger impact on your returns than currency fluctuations.

Common Mistakes to Avoid

Learning from others' mistakes is much cheaper than making your own. Here are the pitfalls that trip up many first-time precious metals investors.

Treating Gold as a Get-Rich-Quick Scheme

Precious metals are long-term insurance, not lottery tickets. If you're hoping to double your money quickly, you're approaching gold with the wrong mindset. The purpose is wealth preservation and diversification, not speculation.

Buying Obscure Products with High Premiums

Fancy coins, unusual bars, or "limited edition" products often carry premiums of 30%, 50%, or more above the actual metal value. You're paying for packaging and marketing rather than gold. Stick with standard, recognised products.

Poor Storage Decisions

Keeping large amounts of precious metals at home without proper insurance is asking for trouble. Conversely, storing them in locations you can't access easily in an emergency defeats some of the purpose. Think through your storage strategy carefully.

Not Integrating Metals into Your Overall Financial Plan

Precious metals shouldn't exist in isolation. They should be part of a comprehensive financial strategy that includes consideration of your other investments, estate planning, and tax implications. Risk management across your entire portfolio is what matters, not any single component.

How to Get Started Safely

If you've read this far and feel ready to add precious metals to your portfolio, here's how to proceed thoughtfully:

Start with Education

Before spending any money, invest time in understanding the basics. Read, ask questions, and make sure you're comfortable with the fundamentals before making your first purchase.

Choose a Reputable Dealer

Work with established bullion dealers who offer transparent pricing, secure delivery options, and professional storage solutions. Check reviews, verify their credentials, and don't be afraid to ask detailed questions about their processes. GRA recommends Gold Survival Guide as reputable dealers – you can contact them as a friend of GRA via this form.

Define Your Goals Clearly

Are you primarily seeking protection against economic instability? Diversification of an existing portfolio? Building a long-term legacy for future generations? Your specific goals will guide your decisions about how much to invest, what products to buy, and how to store them.

Begin Small and Build Gradually

You don't need to hit your target allocation immediately. Many investors find it helpful to start with a modest purchase, become comfortable with the process, and then add to their holdings over time. This approach also helps you dollar-cost average, buying at different price points.

How Should You Hold Gold – in your own name, a trust or a company?

Precious metals intersect with tax planning, estate planning, and overall wealth management. Professional advisers can help you understand how metals fit into structures like trusts or companies, what tax implications you might face, and how to integrate them into your broader financial picture.

The optimal structure depends on your specific circumstances, estate planning goals, and tax situation. This is exactly the type of question to discuss with professionals who are experts in asset planning and tax (like the team at GRA). Get your structure set up first, before you start investing.

Frequently Asked Questions

What's the minimum investment in gold?

Many dealers offer products starting from just a few hundred dollars. Small gold coins or fractional bars (such as 1/10 oz or 1/4 oz) provide accessible entry points. For silver, you can start even smaller, with one-ounce coins typically costing around $100 NZD.

Is it legal to store gold overseas?

Absolutely. Many investors choose to store some precious metals in secure facilities overseas for additional geographical diversification. This can provide protection against country-specific risks. However, this adds complexity regarding tax reporting and estate planning, so again, professional advice is recommended.

Final Thoughts

Investing in precious metals doesn't need to be complicated or intimidating. At its core, investing in precious metals is about adding a layer of financial resilience. Gold and silver are tangible assets that have held value for thousands of years, across economic cycles, political changes, and currency failures. While no asset is entirely immune to market forces, precious metals have historically performed well in times of crisis, offering protection when other assets struggle.

Whether you choose to allocate 5% or 20% of your portfolio to precious metals, the key is approaching this decision thoughtfully, with clear goals and proper professional guidance. Start small, choose reputable dealers, store your metals securely, and view them as the long-term insurance they're meant to be.

Remember, precious metals aren't a substitute for shares, property, or other investments; they're a complement that adds resilience to your overall financial position. With the right approach, they can provide peace of mind and financial security for years to come.

For assistance with purchasing precious metals, we recommend Glenn Thomas, who is a gold and silver dealer at Gold Survival Guide. For an introduction as a friend of GRA, please fill out this form on our website.

For help with tax and ownership structures around precious metals, contact GRA by phoning 09 522 7955 or via our online form.

This article provides general information only and should not be considered financial, tax, or investment advice. Please consult with qualified professionals regarding your specific circumstances before making investment decisions.

Salesh Chand

Partner and Director of Business Services

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

I would like to say thank you for the opportunity for allowing me to come to the property school at Gilligan Rowe + Associates. Im in my early stages of becoming a property investor in New Zealand and to able to come to the property school has enabled to me gain very valuable information and knowledge which will help me be successful in property investing. The property school itself is one like no other because there is so much value given and from experts that practise what they are teaching. This in property school was one of the main highlights because being able to meet experts through the property school was my first time and gave me more confidence in general about property investment. Having combined reading the books (Property 101, Tax structures 101) at home and attending property school, the breath of valuable information and knowledge I have attained is substantial. - Tesfalidet, December 2019

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More