Those of you who are knowledgeable about the NZ mortgage landscape may have heard in the past about Resimac’s Specialist Investor Product. This offered a great longer-term solution for those who wanted to hold investment properties but couldn’t meet overly cautious bank affordability criteria.

While this product left the market a while back, the initial signs are that it may have been replaced by something even better.

What makes this new investment property lending solution different?

While we are still working through some test cases, indications are that there is a new competitively priced product which will be very useful for the investor whose equity position is strong but is held back because of how the banks look at their cashflow.

To explain further: as an investor grows their portfolio, there becomes a larger and larger gap between reality, i.e. how an investor will look at their cashflow, and how a bank does.

Why is that?

How banks assess investment property cashflow

The banks tend to scale the rental income to circa 75% of what is received. Then on the mortgage side, they assess everything at considerably higher interest rates (currently assessed at circa 7%). On top of that, even though the investor may have their mortgages on interest-only, they will always be assessed as if the investor is paying principal and interest.

Example – bank vs investor cashflow assessment

Let’s say an investor (we’ll call him John) built a portfolio where he had the following:

• $3.5m of investment property returning a gross yield of 5% ($175k)

• Annual non-mortgage costs of $50k for running the portfolio

• $2m of debt at a 5% interest rate on an interest-only basis

• All debt taken on a 30-year term and was 10 years into the term (i.e. there were 20 years remaining).

The difference between John’s view and the bank’s view is roughly as follows:

What happens for most investors is that they cover the bank’s negative view of their portfolio’s cashflow from their other income streams. Then as their portfolio grows, most tend to eventually hit a ‘servicing’ wall.

New product difference – stand-alone property assessment

What this new product allows is the ability to look at a property on a stand-alone basis and disregard the remainder of the customer’s position.

There are some other rules around this that need to be noted. For instance, generally the funder will look at the entity and how it stacks up. If this proves to be a hurdle, having access to an expert asset structuring firm such as Gilligan Rowe & Associates may provide solutions.

Example – how the new lending formula works

So, let’s say part of John’s portfolio was a $600,000 property that was rented for $700 per week. If other criteria could be met, the way this non-bank lender would view this as follows:

(Rental x 80%) > (mortgage amount on principal and interest x interest rate + 1%)

As this looks confusing, let’s put some more numbers in. The interest rate that John would be charged in this case is likely to be 6.29% (likely dropping to 6.04% after this week’s cash review).

This means that the formula is:

$3031 (monthly rent) x 80% = $2,425

$2,425 has to be more than the mortgage cost on a principal and interest basis with a 1% loading added.

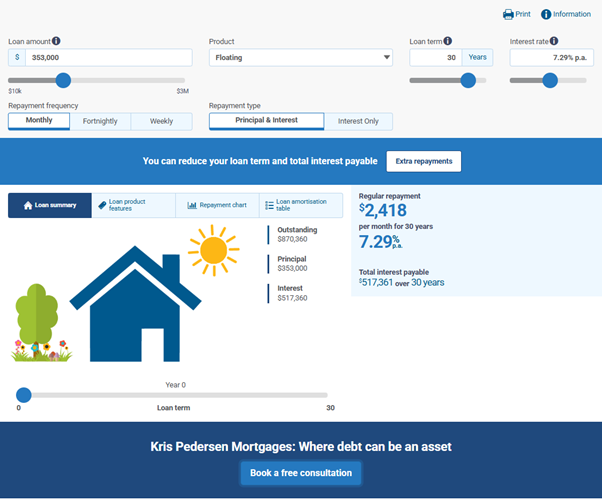

By jumping onto our mortgage calculator at https://www.krispedersen.co.nz/calculator/ and putting in an interest rate of 7.29% (1% more than the interest rate being charged) and then playing around with the loan amount, it can be seen that the maximum loan amount is circa $353k.

Summary

Keep in mind other criteria must be satisfied, but with this product it is possible to get a long-term mortgage at rates close to a bank floating rate when otherwise the investor may be locked out of the market.

If you would like to discuss this further or have any questions, please contact Kris Pedersen here.

Kris Pedersen

Managing Director at Kris Pedersen Mortgages

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

Thanks John, You have been an excellent person and firm to deal with over the last ten years. Kerrie and I have really appreciated your advice. - Andrew and Kerrie - Brisbane, August 2018

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More