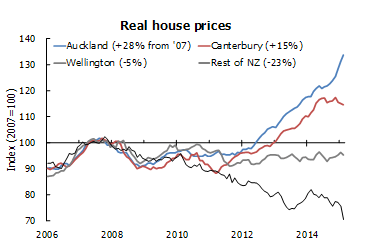

The new LVR rules, combined with Auckland's lack of affordability, are pushing money out of Auckland and into the regions. This ripple effect is highly predictable, given that Auckland is cycling ahead of the rest of the country (followed closely by Canterbury), as evidenced by the graph below.

Source: NZIER Quarterly Predictions, March 2015

In relation to this graph showing Auckland versus the rest of the country, I think it would be fair to say this can't go on – eventually the regions will catch up (due to the ripple effect).

I recently spent time in Tauranga, and feedback from the agents there is that 60% of auction attendees are Aucklanders - investors with cash seeking 80% leverage. This didn't surprise me. (Investors can only get 70% LVR in Auckland under the new rules, which come into force on November 1. I recently wrote a blog about these LVR rules, which you can read here.) I am also hearing similar anecdotal feedback from Hamilton.

The regions look attractive at the moment, with comparatively good buying and expected increases in values due to the ripple effect spreading out from Auckland. However, the question investors should be asking at this time is, 'What happens when we go into the next downturn?' How much of the increase in value do you get to keep and how much falls away due to the volatility of the local markets in the regions versus more robust markets?

What reduces volatility in a down market?

I cover this topic extensively in my book Property 101. When the property cycle enters the downturn phase (which it inevitably does at some point), some places suffer less significant drops in value and recover faster than others, i.e. they are less volatile. The factors that reduce volatility are:

- Good supply/demand fundamentals. Pick areas with growing population and tight supply of housing.

- Stable employment. Pick areas with high average incomes and diversified employment. Stay away from low income towns and one-horse employment towns with limited opportunities.

Obviously Auckland has the best fundamentals with its own self-propelling economy, diversified employment, high average incomes, high population growth and extremely tight supply/demand fundamentals. But is it heading to the top of the cycle?

If you ask me to guess the growth over the next 18 months, I'd say Auckland has another 10–20% upside left for capital growth by the end of 2016. At that point I expect the market to top out, and move to the downturn phase by the end of 2017.

Ask me what I think Tauranga, Hamilton and possibly Wellington will do in the next 12–18 months to the end of 2016, and I'd guess growth at 20–40%. Why? Because they are cycling behind Auckland and benefitting from the ripple effect and LVR rules.

What about other smaller centres?

I think smaller centres will likely benefit from the ripple effect and LVR changes too, but ask yourself which of these areas will crash in value when interest rates go up or the market moves into the down cycle. In my experience, rapid house price growth in areas with low incomes is more volatile and prone to crashing because, plainly speaking, the owners of property don't have the incomes to fund the interest required to pay for assets at inflating values, and tenants don't have the incomes to afford higher rents.

So the smaller centres tend to crash harder than the main centres that have better supply/demand fundamentals and higher incomes, where people have the money and the bulk of the immigrants go.

Summary

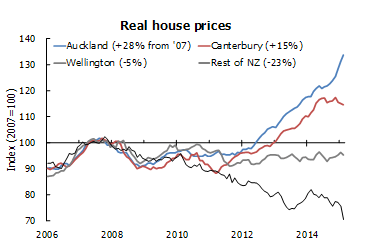

By all means chase the growth that is rippling out of Auckland – I thinks it's a great idea. But be aware that the financial hangover in small towns is much worse and lasts longer than in the areas with better fundamentals. I will repost my favourite graph to demonstrate this point.

Source: NZIER Quarterly Predictions, March 2015

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

Our experience with GRA so far has been great. Being a young couple, trying to get into investment property, there has been so much to learn and so much we simply didn't understand. You have been so patient with us, and have answered all our questions without judging. In fact you even gone so for as to offer us advice on more than just the accounting side of things. Overall, dealing with any of the staff from GRA is always a pleasant experience. Thanks. - L Schwalger

Property 101by Matthew Gilligan

Investing in residential property?

Put this at the top of your reading list.

If you're investing in residential property, seeking to maximise your ability to succeed and minimise risk, then this is a 'must read'.

Matthew Gilligan provides a fresh look at residential property investment from an experienced investor’s viewpoint. Written in easy to understand language and including many case studies, Matthew explains the ins and outs of successful property investment.

- How to find the right property

- How to negotiate successfully

- Renovation do's & don'ts

- Property management

- Case studies and examples

- and much, much more...