The government have made changes to two areas of legislation that affect property investors: tax (interest deduction and bright-line), and the Resource Management Act.

Tax Changes

In October the government finally introduced legislation into parliament setting out the proposed interest deduction rules. Here is a summary of the highlights.

a) We still do not have finalised legislation. Even these draft rules are yet to go through select committee. I do not expect it to be finalised legislation until around March next year and there could still be changes to come. Highly unsatisfactory.

b) The definition of new build is different to expectations. Any property where CCC is issued on or after 27 March 2020 qualifies. The reference to 2020 is not a typo. This broadens the catchment of the new build definition, which was previously expected to apply to new builds where CCC was issued after the announcement in March 2021.

c) Interest can be claimed on borrowing in relation to new builds for a 20-year period. The 20 years runs from the issue of CCC. This means that multiple investors may be able to claim interest in relation to the same property as it changes hands over time - until the 20th anniversary of the issue of CCC arrives.

d) A new exemption has been included for properties that are rented out as social housing. This is a welcome inclusion for investors who rent properties to the Crown or community housing providers.

e) There is a real lack of clarity around whether boarding houses are exempt from the rules or not. There is no reference to boarding houses in the list of exempt residential property, but accompanying commentary suggests that “larger” boarding houses could be regarded as “hostels”, which are a listed exclusion. Naturally there is no definition of a hostel nor what constitutes a “larger” boarding house.

f) Interest that cannot be claimed as deductible will be able to be offset against any subsequent taxable gain realised when a rental property is sold. While this would be common sense drafting to most readers, it was not an assured outcome, so I am pleased to see this taxpayer-friendly inclusion.

g) The proposed “rollover relief” rules have been included. This is also taxpayer friendly and will allow investors to restructure the ownership of assets without triggering adverse tax consequences in certain circumstances. However, there are catches to this and it does not apply as widely as it should.

h) A five-year bright-line period has been confirmed for the sale of new build property, with the definition for these purposes being a property acquired before 12 months have passed from the date of issue of CCC.

i) There has been further amendment made to the main home exemption from the bright-line rule. What once qualified as a reasonably complex definition has now flowered into a near indecipherable mixture of multiple defined terms and mathematical formulas that would take me several pages to explain to readers.

So in summary, some good mixed in with the bad, but still not finalised law yet. Keep an eye on our Tax Changes Resources webpage where we will post updates as they come to hand.

RMA Changes

With cross-party support, the government recently announced arguably the most systemic changes to development controls that New Zealand will witness in our lifetime. Essentially, the main features that enable high-density housing under the Auckland Unitary Plan are being spread across much of NZ. However, the proposed rules have reduced or no parking requirements and even more permissive controls than those adopted in Auckland. The rules will release huge development potential for infill housing and high-density development across the country.

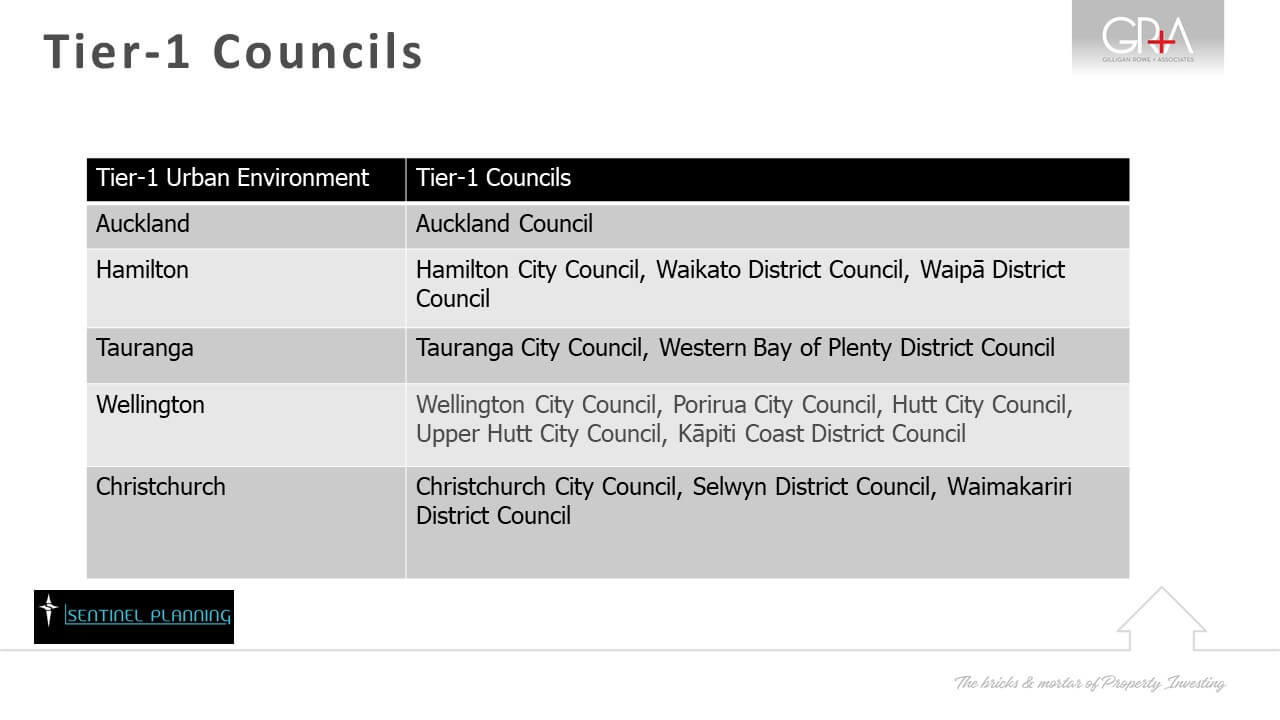

The changes are part of the Intensification Streamline Planning Process (ISSP), and will cause the main centre Tier 1 Councils and a year later, Tier 2 Councils to adopt the standards a year faster than under normal RMA timeframes. Councils are required to report back with their proposals to adopt the suggested framework by August 2022. If councils do not get on board with the proposed density and development controls, the government, through the independent hearings panel, will force the changes into their district plans.

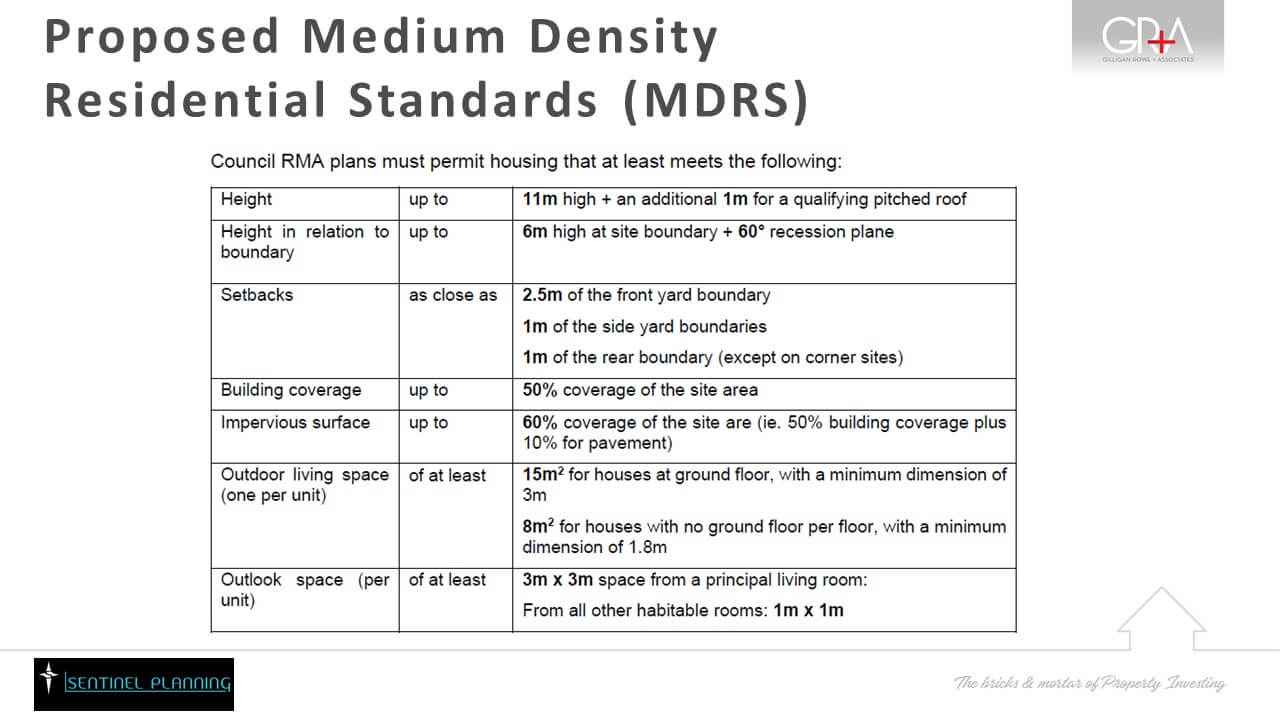

The proposals might be characterised by Aucklanders as Mixed Housing Urban (MHU) zoning, with more permissive height in relation to boundary (HIRB) rules (more like the THAB HIRB rules), and with even smaller living courts and outdoor living spaces. Let’s call the proposed Medium Density Residential Standards “MHU on steroids”.

Below are the proposed Medium Density Residential Standards (MDRS) that will release huge volumes of permitted dwellings across NZ in areas traditionally restrained by density rules (e.g. one dwelling per 450m2 or 600m2).

These rule changes represent great buying opportunities for informed and astute investors across NZ, just as early adopters profited in Auckland prior to the implementation of the AUP from 2013 onwards. If you would like to catch up on the detail, watch my recent webinar with town planner, Simon O’Connor from Sentinel Planning about the RMA Changes.

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

I found Matthew Gilligan’s Property 101 and Tax Structures 101 to be superb books for the following reasons: 1. They contain a wealth of information about property investing and related tax matters; 2. The commentary is very rounded and balanced; 3. They are filled with financially savvy practical tips and red flag warnings; and 4. The relatively informal style, use of short case studies and anecdotes to illustrate points, and the clarity of presentation make the books very reader friendly. The above combine to make two books that are educational, thought provoking and inspiring. I only wish I had access to this information much earlier. - Geoff W - April 2016

Property 101by Matthew Gilligan

Investing in residential property?

Put this at the top of your reading list.

If you're investing in residential property, seeking to maximise your ability to succeed and minimise risk, then this is a 'must read'.

Matthew Gilligan provides a fresh look at residential property investment from an experienced investor’s viewpoint. Written in easy to understand language and including many case studies, Matthew explains the ins and outs of successful property investment.

- How to find the right property

- How to negotiate successfully

- Renovation do's & don'ts

- Property management

- Case studies and examples

- and much, much more...