Whether you are a businessperson signing contracts and leases in the ordinary course of business, a property investor signing finance agreements with banks, a property trader, or a developer, you will no doubt want to pay as little tax as legally required and protect the assets you’ve worked so hard to attain.

So how do you do this? Should you set up a company? A trust? Both? Neither?

The answer is in the asset planning process, and the objectives are threefold:

1. To protect your assets

2. To plan your estate

3. To effectively and efficiently manage tax

As discussed in our Tax & Trusts webinar (you can watch the recording here), without a good asset plan, your assets could unnecessarily land in creditors’ hands, the beneficiaries of your estate might not get what you intend to leave them, and you could end up paying too much tax (or not enough and then get into trouble with IRD).

If your trust succession arrangements are incorrectly set up, your children could lose control of your trusts to lawyers or accountants. If your trust is not administered correctly, it could become a sham trust and be deemed invalid, causing the assets of the trust to become available to creditors or spouses, or suffer adverse tax consequences.

The devil is always in the detail, and sometimes the detail is out of date or just wrong.

Where do you start with asset planning?

To achieve the right outcome, you need tailored advice from experts who understand the tax, legal, and estate planning aspects of your situation. Be careful of one-sided advice from an accountant focusing on tax, or a lawyer focusing on the law. You need both disciplines working together to achieve an effective asset plan.

The first step a good asset planner will take when planning for success, is to plan for failure. This may sound counterintuitive, but asking the question “what if you knew you would be bankrupt next year?” will mean you can put things in place to minimise the damage, should the worst occur.

Of course you don’t set out in life or business expecting a financial disaster, but left field events can happen (e.g. dishonest business partner, an uninsured contractor working on your investment property who damages a neighbour’s house or public infrastructure, or a business failure). If you have good tax and trust structures, the negative impact of such an event on you and your family will be greatly reduced.

What happens if you don’t have an asset plan?

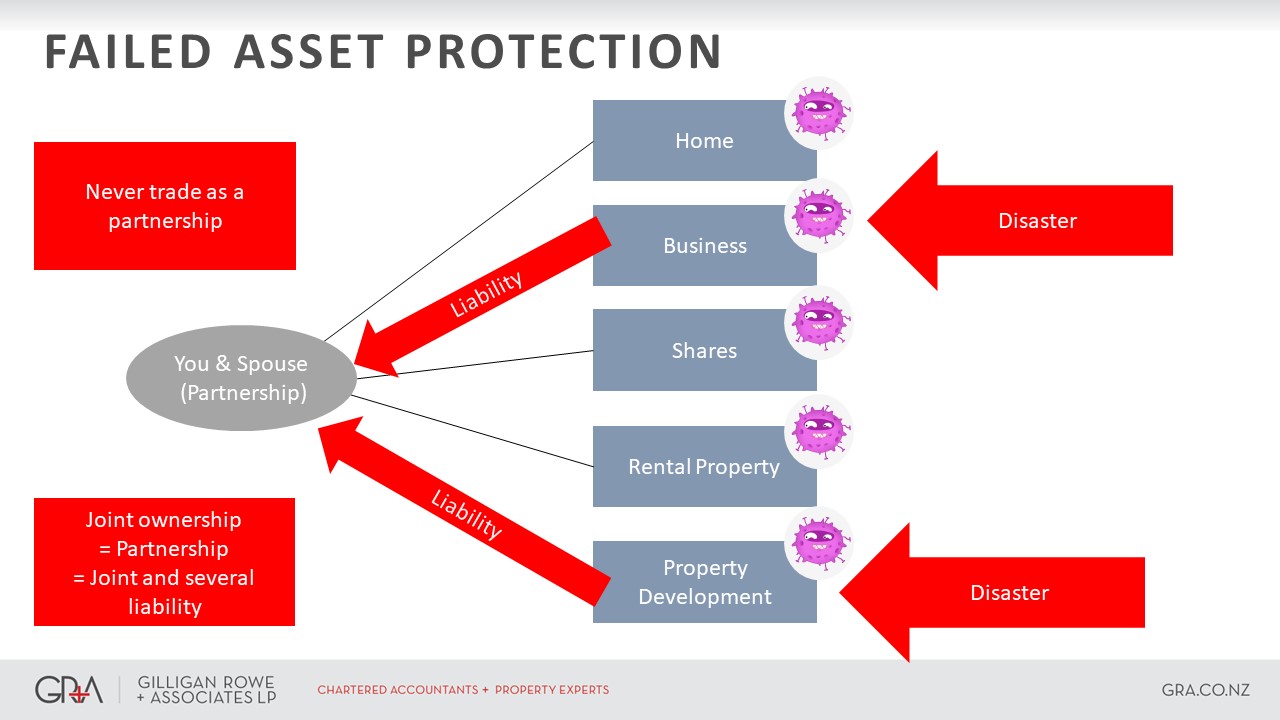

If you don’t address these sorts of issues, you will likely end up with a structure that completely fails at asset protection, where you (and your spouse) are liable for all business disasters that may occur and possibly end up bankrupt as a result. And don’t forget the banks – you need to carefully structure debt so your family home is not on the line if your businesses fail.

A structure like the one illustrated below is an example of how a poorly structured asset ownership plan causes all assets to become available to creditors. We’ve seen many people in this situation, who’ve make the mistake of thinking “my risk is low, what could possibly go wrong?” – without actually thinking about what could go wrong.

© Gilligan Rowe & Associates LP 2023

These people should have traded in a company, and had their assets held in trust. This would have quarantined the risks away from their family home and other business assets.

But then how does the tax work? It all needs to fit together, and moving assets can create tax disposal costs if not carefully thought through. So it’s not just a simple exercise of moving assets around with legal agreements; the tax planning needs to be done with the asset protection.

Explaining asset planning more fully

These concepts and sample asset planning structures are more fully explained in GRA’s Tax and Trusts webinar, which is free for you to view.

As always, seek professional advice before deciding on an asset plan. We’d be pleased to meet with you to discuss your situation to see how we can help.

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

Salesh Chand is great to deal with on asset planning, tax planning and discussing wider business and market implications. Day to day I deal more with Alex Gackovich who is very responsive. Their combined knowledge plus that of the wider GRA team is impressive.

- Ben Robinson, October 2023

Property 101by Matthew Gilligan

Investing in residential property?

Put this at the top of your reading list.

If you're investing in residential property, seeking to maximise your ability to succeed and minimise risk, then this is a 'must read'.

Matthew Gilligan provides a fresh look at residential property investment from an experienced investor’s viewpoint. Written in easy to understand language and including many case studies, Matthew explains the ins and outs of successful property investment.

- How to find the right property

- How to negotiate successfully

- Renovation do's & don'ts

- Property management

- Case studies and examples

- and much, much more...